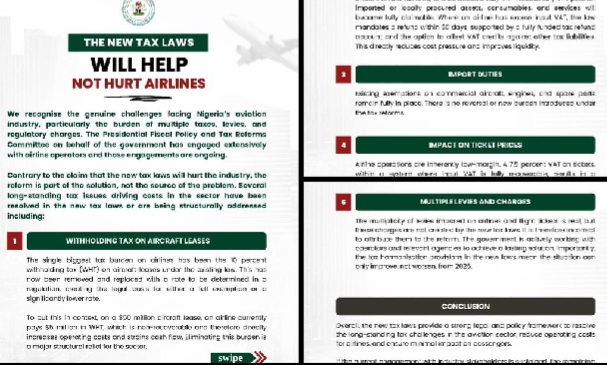

The Federal Government has moved to allay fears within Nigeria’s aviation sector, insisting that the new tax laws are designed to ease costs, stabilise operations, and strengthen airlines—not cripple them.

Speaking through the Presidential Fiscal Policy and Tax Reforms Committee, government officials acknowledged the real pressures facing airline operators, particularly the long-standing burden of multiple taxes, levies, and regulatory charges. They stressed that continuous consultations with airline operators are ongoing to ensure the reforms deliver real relief.

Contrary to claims that the new laws will hurt aviation, the government said the reforms directly tackle the sector’s biggest pain points.

Big Win on Aircraft Leases

One of the heaviest burdens on airlines—the 10 percent withholding tax on aircraft leases—has been scrapped under the new legal framework. Previously, airlines paid millions of dollars in non-recoverable tax on leased aircraft, draining cash flow. The new law now allows for either full exemption or a much lower rate, offering major structural relief to operators.

VAT: From Silent Burden to Full Refunds

While the COVID-era VAT suspension looked attractive, airlines were quietly absorbing unrecoverable VAT on assets, consumables, and services. Under the new tax laws, airlines become fully VAT-neutral. Input VAT can now be claimed back, refunded within 30 days, or offset against other taxes—freeing up liquidity and reducing hidden costs.

Government confirmed that existing exemptions on commercial aircraft, engines, and spare parts remain intact, dismissing fears of new import-related costs.

Officials explained that even with a 7.5 percent VAT on tickets, the real impact is far lower than suggested because airlines can recover input VAT. In simple terms, a ₦125,000 ticket would rise by no more than ₦9,375, while a ₦350,000 ticket would increase by a maximum of ₦26,250—far from the alarmist projections circulating.

The reforms also pave the way for a reduction in corporate income tax from 30 percent to 25 percent. Multiple profit-based levies have been collapsed into a single Development Levy, cutting red tape and improving certainty for airlines.

The government admitted that multiple levies across agencies remain an issue, but clarified that these were not created by the new tax laws. Discussions with regulators and operators are underway to deliver a lasting solution.

In conclusion, the government maintained that the tax reforms are a lifeline for Nigeria’s aviation industry—removing long-standing bottlenecks, improving cash flow, and setting the stage for a more competitive and sustainable airline sector.